Six months after the introduction of the first tariffs on steel and aluminum (and nearly one year after action taken on Canadian soft lumber), the impact on construction is both very clear and difficult to quantify.

Since the May 2018 reading on producer price indexes (PPI) related to construction, year-over-year inflation on inputs for construction remains elevated. In the five months measured since then, inflation has been above 8% higher than in the same month of 2017. Much of this increase has come from the anticipation of tariffs, as the actual tariff calculations on most finished products have not been completed. Many manufacturers hiked prices about 15% as soon as tariffs were announced as a hedge against what the heightened costs of components and raw materials would be. Further, a number on products unaffected be tariffs also saw increases, as manufacturers and distributors seized on the opportunity to push the market higher after an extended period of pricing pressure.

In September, the Associated General Contractors of America (AGC) issued its analysis of the tariffs, which understandably included little assessment of the exact impact. Some of the detailed analysis of the impact done by other associations was somewhat inconclusive. Assessments of the impact on jobs ranged between 10,600 and 66,000 construction jobs. The National Association of Homebuilders estimates that the price of the tariff-affected products would raise the material cost of a new home by 10%, but its estimate of the impact on home prices was $9,000 more for single-family houses and $3,000 per apartment unit.

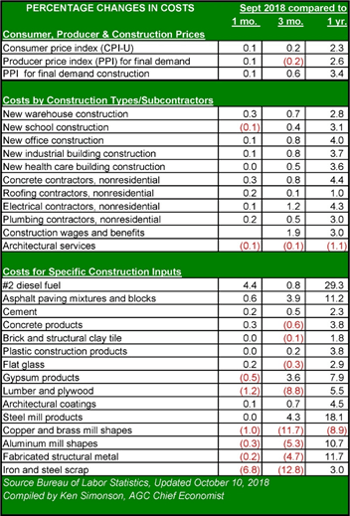

The Bureau of Labor Statistics (BLS) data on September’s inflation, which was reported on October 10, was consistent with the trends of spring and summer. The BLS report showed month-to-month inflation slightly higher again, with year-over-year increases still in the 7-8% range. In other words, the spike in May was something of a one-time jump that has become the new plateau for construction prices.

In September, the producer price index (PPI) for inputs to construction industries increased 0.2% from August and 6.2% since September 2017, while the index for goods excluding services rose 7.4% year-over-year. Materials that had significant inflation from September 2017 to September 2018, diesel fuel (29.3%), steel pipe and tube (22.1%), fabricated structural metal (11.7%), asphalt paving mixtures and blocks (11.2%), and aluminum mill shapes (10.7%). Most of these hikes were tariff-related, although most of the data collected on September PPIs predated that implementation of the tariffs. Feedback from the BLS survey indicated that suppliers were passing on the hikes and warning that the tariffs are scheduled to jump from ten percent to 25% in January.

Hurricane Florence and Hurricane Michael will also likely have an effect on input prices into the early months of 2019. Losses of materials and disrupted shipping due to the extended flooding have pinched supply chains. Demand for rebuilding, when damage is sorted out, will also push prices up. The intensity of the storm impact is, at this point, still unknown.

Of concern for 2019 are the prospect of more trade wars from the Trump Administration and another spike in oil prices. Absent any change to the strong employment market, it’s likely that perceived trade imbalances will be met with tariffs or other punitive measures that will provide upward pressure on prices. The supply and demand dynamics of the oil market are currently trending higher for the next year. Industry forecasts for benchmark crude oil have been as high as $100 per barrel in 2019. That level of pricing will ripple through construction, causing input-related price increases in diesel fuel, asphalt, roofing and other products derived from oil, as well as fuel surcharges that will affect the transportation of products and materials. Reprinted with permission from BreakingGround Magazine

Share