The holidays are fast approaching and you’re preparing for the end of 2018. As you make your holiday shopping list, you remember that tax season is just around the corner. Since December is typically the time of year that you pay for your tax-deductible items, you go ahead and do so. Of course, you want to reduce your tax liability as much as possible; it’s the smart move. However, with the tax reform of 2017, the game has changed. Tax reform increased the standard deduction to $24,000 for those married and filing jointly, and $12,000 for single filers. The biggest change is that most itemized deductions were eliminated, however here are a few that still remain:

- state and local taxes

- mortgage interest

- charitable contributions

- healthcare

For most of us, the standard deduction will be greater than all of these combined.

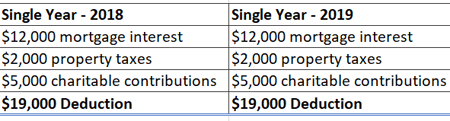

Example: The Smiths, a married couple, have the following itemized deductions in a single tax year (2018):

- $12,000 in mortgage interest

- $2,000 in property taxes

- $5,000 of charitable contributions

- Total deduction for 2018 = $19,000

Considering that the standard deduction for married couples filing jointly has been raised to $24,000, the Smiths would take the standard deduction for this year. However, if itemized deductions are higher or close to the same amount, could they increase their deduction? How? By changing when you pay expenses.

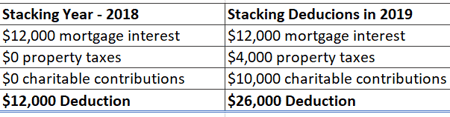

Combining years of taxes and contributions, or stacking, can be very beneficial. Instead of paying expenses each year, combine deductions into even or odd years.

Example:If the Smiths pay their deductions each year, their total deduction each year is $19,000:

If the Smiths stack their tax deductions in odd years, they now have a $26,000 deduction in the odd year:

Over two years, the total deduction is $50,000 instead of $38,000. This is a simple calculation, but it’s easy to see the benefit!

NOTE: state and local taxes are now limited to $10,000 per year. The only exception to this rule is for an income-producing property, so this must also be considered. Stacking deductions in even or odd years can be very beneficial.

When filing your taxes, it’s important to consult with your trusted tax advisor to ensure you are filing correctly to receive your maximum deduction.

Share