Imagine if you could depreciate your manufacturing facility seven times faster; well, maybe you can.

Cost segregation, a near-term tax burden reduction technique perhaps especially attractive to manufactures given their capital-and-facility-intensive business, is now in its second decade since changes in federal law thrust it into the tax spotlight. The recent issuance of final Treasury regulations on dispositions of property makes this an excellent time to consider or revisit a cost segregation study.

Tax savings under cost segregation can be significant. Cost segregation enables businesses to depreciate new or acquired structures, leased or owned – or portions of them - up to seven times faster than standard depreciation for buildings. In 2002 and 2003 federal tax law changes in the deprecation rules brought about cost segregation as we know it today.

Cost segregation pulls savings and cash flow up in time and pushes your tax burden to a later date. Numerically speaking, depreciation on buildings or property that once required 39 years can, under cost segregation, be reduced to 5, 7, or 15 years.

Typically a manufacturing company will pay a general contractor to build a building or portion of its physical plant. Without proper support this building must be depreciated over 39 years. A cost segregation study “segregates” the cost of the building into components that can be depreciated using shorter lives and faster methods. Cost segregation doesn’t eliminate, or even substantially reduce, taxes; however, it does give you longer to pay them. This deferral of tax will increase current cash flow enabling you to take advantage of the savings for investment in the business, plant or inventory expansion, or whatever purpose you choose.

Cost segregation isn’t something you do by sitting down with your accountant and figuring out what you think fits the criteria. To keep you from long and expensive visits to an IRS office explaining your conclusions on how and why you should enjoy the tax advantages you claimed, you’ll need a well-done cost segregation engineering study. This study must be performed by experts who understand engineering like an engineer, construction like a contractor, and have the accounting ability to provide convincing evidence to support the study’s cost segregation findings.

The IRS suggests that cost segregation studies be performed by "…personnel competent in design, construction, auditing, and estimating procedures relating to building construction" (PLR 7941002). At the same time, there are no set-in-stone requirements for how cost segregation studies should be prepared. Here’s what the IRS’s audit techniques guide says on the subject:

“Neither the Service nor any group or association of practitioners has established any requirements or standards for the preparation of cost segregation studies. The courts have addressed component depreciation, but have not specifically addressed the methodologies of cost segregation studies...Despite the lack of specific requirements for preparing cost segregation studies, taxpayers still must substantiate their depreciation deductions and classifications of property. Substantiation using actual costs is generally preferable to the use of estimates. However, in situations where estimation is the only option, the methodology and the source of any cost data should be clearly documented. In addition, estimated costs should be reconciled back to actual costs or purchase price.”

When searching for a capable cost segregation study firm you must confirm that the professionals involved have the proper training and expertise as required by IRS standards. BDO, for example, created an internal team of engineers, accountants, and contractors to prepare cost segregation studies for clients; Rodefer Moss is a member of the BDO Alliance, an association of hundreds of privately-owned firms with which BDO shares knowledge and resources. Additionally, Rodefer Moss has been specializing in accounting and business solutions for the construction industry since 1990.

Cost segregation offers benefits, but not without cost, and not without some risk. What do you need now, what position do you think you’ll be in later and how will cost segregation and its near-term tax savings fit into your plan?

Talk to professionals who know how cost segregation can benefit manufacturers. It can’t hurt, and it certainly might help.

Here is an example to help you understand the breakdown of the cost segregation:

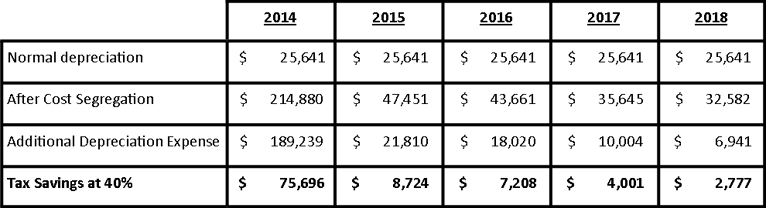

In 2014, ABC manufacturer built a building for $1,000,000. The annual tax depreciation for that building would be $25,641. A hypothetical cost segregation could convert 10% of the costs to 5 year, 15% to 7 year and an additional 10% to 15 year. Following is a chart of the recomputed depreciation and annual tax savings:

As you can see in this example cost segregation puts an additional $100,000 in the manufacturer’s pocket over the first five years, or 10% of the cost.